It would be naïve to believe that we aren’t experiencing aftershocks from Covid.

According to data, the pandemic caused over 1.1 million American, nearly 60,000 Canadian, and over 2.2 million European deaths. Overall, over 7 million people died from the disease, and we are struggling to understand the impact of Long Covid.

It forced millions into hospitals, wreaked havoc on the economy, forever changed the way we interact with each other, and parents are still sorting through the negative impacts on their children’s academic, social, mental, and physical health.

The pandemic also caused large-scale economic shocks, changing the overall financial landscape and affecting foundational structures of how we work, live, and play. It exposed vulnerabilities in supply chains, reconfigured the workforce, shifted real estate markets, and transformed education.

Life has changed.

Mental Health & Innovation in Virtual Care

The pandemic impacted mental health in many ways. It affected individuals with no prior history of anxiety and depression and exacerbated symptoms in those with pre-existing conditions and comorbidities. Mental health visit rates to primary care increased, driven largely by anxiety and depression.

According to the Centers for Disease Control and Prevention’s National Center for Health Statistics, during the pandemic, telemedicine and virtual care usage increased from 15.4% to 86.5%. Private equity recognized the opportunity.

Investment in digital health followed the pandemic’s curve. In 2019, before the pandemic, digital health funding in the US was approximately $8.18 billion. In 2022, it reached $29.2 billion. However, free cash flow from these investments is rare, and in many cases, not on the horizon, resulting in last year’s dramatic investment decrease to $10.7 billion.

Telehealth as a Complement

Fierce Healthcare gives an excellent breakdown of the investment curve here. Investment in telehealth was a major driver in digital health investments and accounted for 30% of total digital health funding in 2021.

It is important to note that telehealth is a complement to traditional therapy. More than a handful of times during, and after, the pandemic my family used telehealth – and the product was great. It allowed for easy scheduling and eliminated the need to travel. A virtual waiting room is much better than a real one, and for some reason it seemed easier to speak to someone over webcam than sitting across from them. To be honest, if a physical examination is not necessary, I can’t see myself traveling to see a healthcare professional in the future.

But we now have dozens of virtual health providers, all attempting to differentiate from each other by specializing in specific populations (children, young adults, elder care), indications (couples therapy, dermatology, dietitians), or claims to unique IP (ePrescribing, tracking technologies, matching services). Like other areas in digital health, there are now too many complements.

As a result, we find ourselves in the midst of 2024, with many established digital health companies trying to raise enough funds to stay solvent. Meanwhile, private equity has switched focus, with technologies claiming to be AI miracles now driving investment interest.

Supply & Demand

We can engage in lengthy debates on whether our financial markets are rational or irrational or efficient or inefficient.

However, by using telehealth as a proxy, we can lean on a fundamental construct in economic theory to help explain the rush to the massive investment in digital health and what we should do next: Supply & Demand.

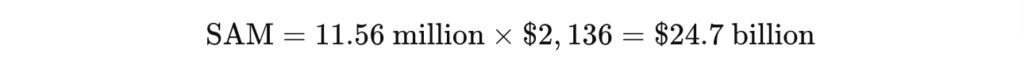

Demand: Using the United States as an example, the National Institute on Mental Health notes that in 2021, approximately 57.8 million people experienced mental health problems, with anxiety and depression being prominent. A conservative estimate is that 20% (11.6 million) seek treatment. With an annual average treatment cost of $2,136 per person, a conservative Serviceable Attainable Market (SAM) is $24.7 billion.

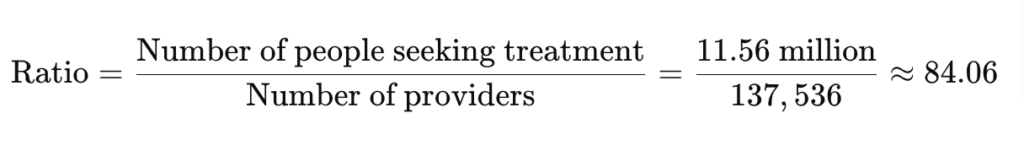

Supply: Somehow overlooked by investors is the lack of mental health practitioners and lengthy wait times. Becker’s Behavioral Health indicates that in the United States, there are 56,536 practicing psychiatrists. Numbers vary, but sources state that there are between 71,730 and 81,000 employed clinical and counseling psychologists (let’s go with 81,000).

Demand – Supply: When we consider state and licensing limitations and the ability to pay, we can see that while a SAM of $24.7 billion is a good number, there is an overwhelming deficit: the ratio is approximately 84 people seeking treatment per provider.

What’s alarming is that this is a vastly oversimplified model. One source estimates that there are 350 individuals for every one mental health provider. Another indicates that there are 33.9 licensed psychologists per 100,000 Americans.

What our oversimplified model does not consider are:

- Many psychiatrists only work with patients with severe mental illness; telehealth is not an option for these practitioners or their patients.

- Trained therapists, other than psychiatrists and psychologists, can also administer treatment and help with the workload.

- Treatment extends far beyond anxiety and depression. People need help with alcohol and substance use, marriage counseling, childhood behavioral issues, finances, tobacco cessation, eating disorders, social anxiety, PTSD, and a myriad of other issues.

- The type of therapy and its average duration needs to be considered. For example, cognitive behavioral therapy, a popular type of treatment, is highly variable and is typically delivered between 7 to 20 hourly sessions.

- Due to shortages, therapists will be able to continue to command wage increases and preferred schedules.

No matter how you look at it, demand outpaces supply and, for the foreseeable future, will continue to do so. We can either increase efficiency of (already overworked) therapists or use digital tools to transform mental health services and assist with this demand.

For those who can afford it, having access to an online therapist is an act of convenience, but telehealth as a complement does not address our inability to meet the SAM.

Year of Reckoning

2024 has been deemed the year of reckoningfor digital health, with a predicted turnaround in 2025. With several bankruptcies and de-listings in 2022-2024, what advice do digital health experts give?

- In Christina Farr’s recent post on the Second Opinion newsletter, she writes about point solution fatigue for employers and calls on point solutions to integrate more closely with each other.

- In his recent newsletter, Preston Alexander notes that virtual care is essentially a feature, not an all-encompassing solution. In-person care should be augmented by virtual care and increase value by integrating other forms of digital health.

- HIT Consultant Media notes that we should expect to see more mergers and acquisitions in 2024 as larger players seek to consolidate the market.

- Fierce Healthcare notes that because of several issues (Americans’ inability to pay for healthcare, US focus on AI), investments in digital therapeutics are shifting to Europe.

Covid & Mental Health

Statista notes that the mental health toll of Covid appears to be fading; self-reported symptoms associated with generalized anxiety disorder and depression are decreasing. This is positive news.

However, Covid has changed the world. Access to digital health services will continue to evolve with tailored solutions, increased access, and creative interventions that will provide interim solutions to the therapist supply and patient demand problem. AI should help with these problems, but like telemedicine, AI solutions will most likely enhance existing processes and tools and is not a stand-alone miracle cure.

While Evolution Health is focused on making our platform available in foreign markets, we are also experimenting with helping telehealth providers with their workloads.

For example, we are experimenting with Dansk Telepsykiatri in Denmark to offer help to patients on waitlists and give patients exercises to work on between appointments. Once we have enough data to see if this is working, we will fully integrate with telehealth software.

Once the digital health market consolidates, market forces will be able to move toward the original promise of digital health: high reach, lower cost.

Evolution Health offers white-label instances of our interactive, self-guided digital health courses to organizations aiming to facilitate transformative change. Please reach out to us if we can assist you.

If you or a loved one are struggling with mental health or addiction issues, explore our free interactive tools at https://EvolutionHealth.care for immediate support and guidance. No waiting list.